Banking is a complex business. From the customer perspective—especially for individuals and small businesses—banks are mainly businesses that lend money, accept deposits, and facilitate money movements in and out.

There are a lot of nuances and shapes within these three categories, but at the core, this is what most customers perceive. Nothing particularly challenging to operate if you have good technology, processes, and teams.

However, banks’ raw material—fiat money, or currency that is not backed by a commodity such as gold or silver—makes them integral to the economic system. Banks are arteries and veins of the economic system and facilitate the execution of central banks’ monetary policies.

[ Also read Digital transformation: Key considerations for banking leaders. ]

This is a big responsibility that encompasses big risks. Bank failures or misbehaviors don’t just impact this one bank’s continuity or profitability; they have the potential to damage people, businesses, industries, or even national economies.

To some extent, the health of the financial system depends on the trust of people and businesses in the banking system.

This leads to regulation and control. Regulators and supervisors protect customers from the complexity and risks of the banking system, as well as ensure that only non-prohibited activities can occur within. Therefore, banks establish internal controls to make sure their activities are in compliance with regulatory requirements.

Embedded finance

Embedded finance is a transformational move in the financial services industry. It encompasses different business models, such as partnership banking, banking-as-a-service, buy now/pay later, and open finance. Their commonality is that banks leverage other companies as channel partners.

Those models require specific capabilities from the technology, processes, control, and organizational perspective. The journey for banks to embedded finance will be formed by building blocks that provide those capabilities.

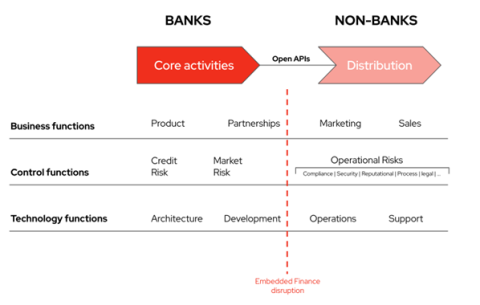

Embedding financial services into nonfinancial customer journeys means that banking services are distributed by non-banks – that is, non-regulated entities.

This has a huge impact on banks’ control functions because all operational risk controls were designed considering distribution channels—either physical or digital—owned by banks. Now, banks must learn how to maintain regulatory compliance and control risks for the end-to-end financial service, even when third parties are part of the value chain.

The disruption is very visible for control functions, but it also deeply affects business and technology functions.

Embedded financial services are leading banks to open their business, control, and technology functions. This is a deeply transformational change as banks are closed by design and for a reason: risk control.

Now that you've seen the challenges, consider the capabilities banks need for embedded finance. Stay tuned for my next article to learn more.

[Want insights on talent and innovation from former financial services IT leaders? Get the ebook: Meet the Bankers.]